In a world starved for some big, shiny policy shift, investors are giddy over post-election euphoria in Berlin. Germany’s conservative comeback, coalition talks, and whispered sweet nothings about ditching the infamous debt brake are fueling the DAX’s sprint to record highs. The mid-cap MDAX is surging, too. But rallies like this always feel unstoppable—until you finally buy, just as it turns. This one is built more on fantasy than fundamentals. Germany’s soon-to-be coalition is about as cozy as sharing a bunk bed with your ex - possible, but not productive.

The debt brake? A constitutional hurdle, not a policy tweak. Ditching it requires a two-thirds majority, meaning Merz & Co. need to charm fiscal hawks who would rather eat glass. Meanwhile, the Bundesbank isn’t exactly cheering - the latest sentiment data suggests more stagnation than acceleration.

And yet, technicals are flashing red. The DAX is nearly 20% above its 200-day moving average - historically a signal for heartbreak. Positioning remains light, hinting that this surge might be more short-covering than real capital rotation. If coalition talks drag out (hint: they will), expect fiscal hopes to fade and markets to sober up fast.

Below, as always, the minimum we need to know to get a feel for what’s cooking:

CTA Liquidations: $100B Sell-Off Ahead?

With US markets on edge, a fresh wave of forced selling may be imminent. Analysts warn that Commodity Trading Advisors (CTAs) could dump up to $100 billion in equities if key technical levels break. These systematic liquidations can snowball fast, especially with volatility rising and margin buffers thinning. The next critical S&P 500 level to watch: 5,900—just a hair below current levels. If that support gives way, momentum-driven selling could accelerate in a hurry.

Crypto’s Crash: A New Market Risk

Recent hacks, regulatory rumblings, and large-scale liquidations have hammered crypto prices. Crypto is now more intertwined with equity markets than ever, thanks to ETFs, single-stock leveraged products, and holdings on major balance sheets. That correlation raises the stakes: a meltdown in digital assets could spill over into broader market sentiment. If volatility spikes or liquidity locks up in cryptoland, brace for aftershocks in equities—particularly tech names with crypto exposure.

Overly Bullish Earnings, Fueled By Buybacks

S&P 2026 earnings estimates are shooting for the moon, far outstripping historic trends. Analysts are racing to rationalize lofty valuations—partly because corporate buybacks keep propping up share prices and artificially shrinking EPS denominators. The danger? Once reality sets in—be it a recession or simply slower economic growth—these projections could sharply revert, blindsiding overconfident bulls. If you’re concerned about buying into a dream, keep an eye on liquidity conditions and actual earnings growth, not just the PR spin.

Get Rich Overnight with Options? Yeah Right...

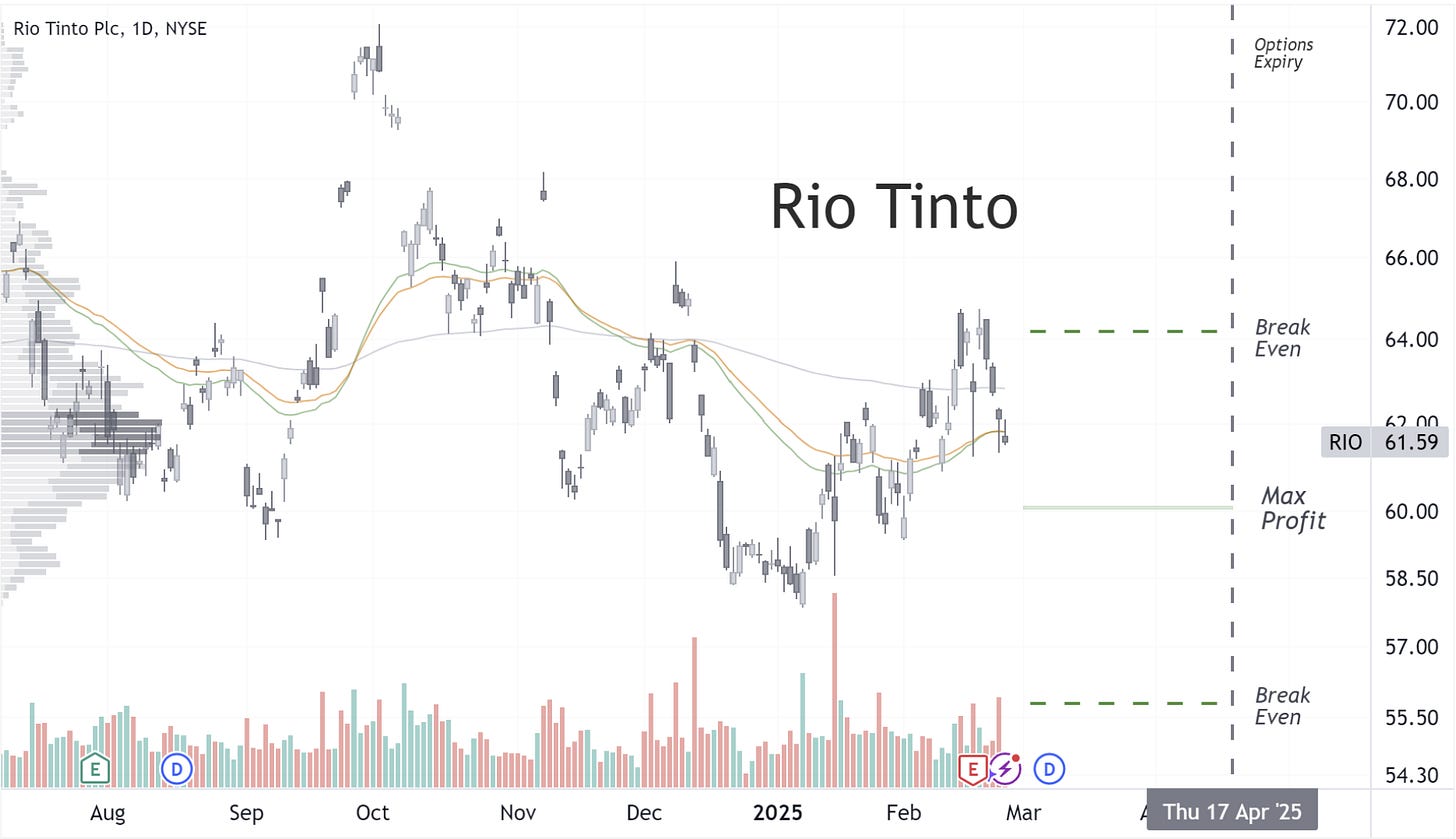

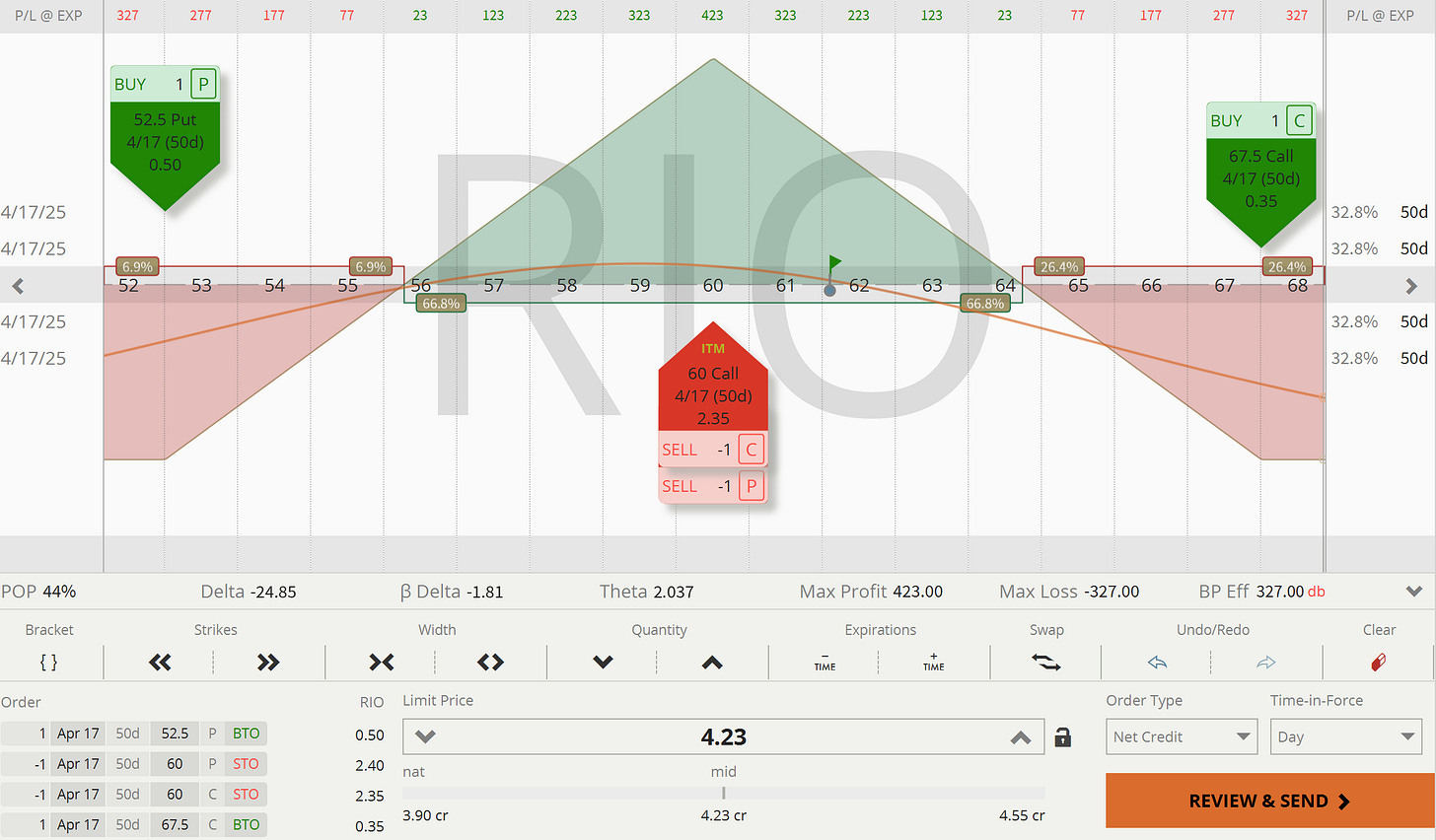

TUESDAY TARGET: We haven’t pulled the trigger on a trade yet, as we are still watching the market. We priced some interesting candidates, and below is a trade we nearly entered yesterday. Maybe later today is the day we make a move.

Some trades look great on paper, but execution is what separates real results from empty hype. If you’re wondering exactly how we are approaching this one—when to enter, adjust, or exit—check out the full breakdown in our Trade Alerts section. No jargon, no fluff—just a clear, step-by-step look at the process.

Whether you're new to options or already working with advanced strategies, sometimes a second opinion or fresh idea can make all the difference. If you want to refine your edge, leverage opportunities more effectively, or discuss smart hedging approaches, let’s connect. No sales pitch, no pressure—just a free, 20-minute strategy session to exchange insights and sharpen your game.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.

Share this post