OK, so what’s the most ridiculous thing some Wall Street tough guy has claimed recently? Our favorite way to kick off the show. Most of those prophets aren’t even selling anything—they’re just curating their egos, spreading wild speculations to fill some void, while being wrong most of the time. We don’t waste time on amateurs. We go for the serious players the herd treats like sages. Why? Because it’s fun to tear apart their dogmas and help our MacroDozer community focus on what really works: self-study, discipline, and constant execution of sharp, innovative strategies.

Which brings us to today’s target: Peter Schiff, the gold-hugging, Bitcoin-hating doom daddy who wants you to believe the U.S. government’s fiscal and monetary system is a Ponzi scheme. Oh yes, Peter is back with another one of his the-world-is-ending-unless-you-buy-gold sermons. Sure, the government has a debt problem—who’s denying that?—but calling its entire system a Ponzi scheme is fear-mongering, Peter, not fact.

Let’s break it down. A Ponzi scheme is a fraud: no real income, no plan to meet obligations, and it collapses without new money. The U.S. government? It has legitimate tax revenues, global creditworthiness, the power to print currency, and tools to manage spending and borrowing. Peter ignores that debt isn’t absolute—it’s about its relation to the economy. As long as economic growth outpaces debt (a.k.a. manageable debt-to-GDP ratio), the system works. And unlike a con man’s house of cards, the government is permanent. So while Peter bangs on about collapse and Ponzi analogies, reality quietly disproves him—making us wonder if his gold pitch isn’t the real scheme.

Below, as always, the minimum you need to know to get a feel for what's cooking:

Leverage and Speculation Reach Dangerous Highs

Speculative excess is sweeping the markets, with options trading and leveraged single stock ETFs reaching unprecedented levels. Investor confidence has soared to record highs, fueled by years of outsized returns and political tailwinds. But history shows that such speculative frenzies often end badly, with sharp corrections following periods of exuberance. Speculative activity reflects the kind of all-or-nothing thinking that maximalists thrive on. While they shout about gold or crypto, the real risk lies in the unchecked leverage that amplifies losses when the music stops.

Federal Reserve Rate Cut in December

Recent comments from Federal Reserve Governor Christopher Waller suggest a continued turn towards rate cuts, with a 25bp cut likely at the December meeting if upcoming employment data permits. While progress on disinflation appears to have stalled, this potential easing could provide short-term relief to the markets. However, such moves also fuel the speculative dynamics mentioned above, creating a dangerous loop. Let's watch Powell's guidance and broader labor market data to manage these moves - and remain wary of maximalist narratives that oversimplify monetary policy realities.

US Manufacturing Sector Shows Signs of Revival

One real bright spot among the noise is the resurgence of U.S. manufacturing, spurred by policies such as the Inflation Reduction Act and the Chips Act. Rising construction activity for new manufacturing projects suggests optimism about domestic production, even if employment hasn't yet caught up. While the noisy prophets of the world love to accuse government of inefficiency, these initiatives show how well-targeted policies can create real economic growth.

Get Rich Overnight with Options? Yeah Right...

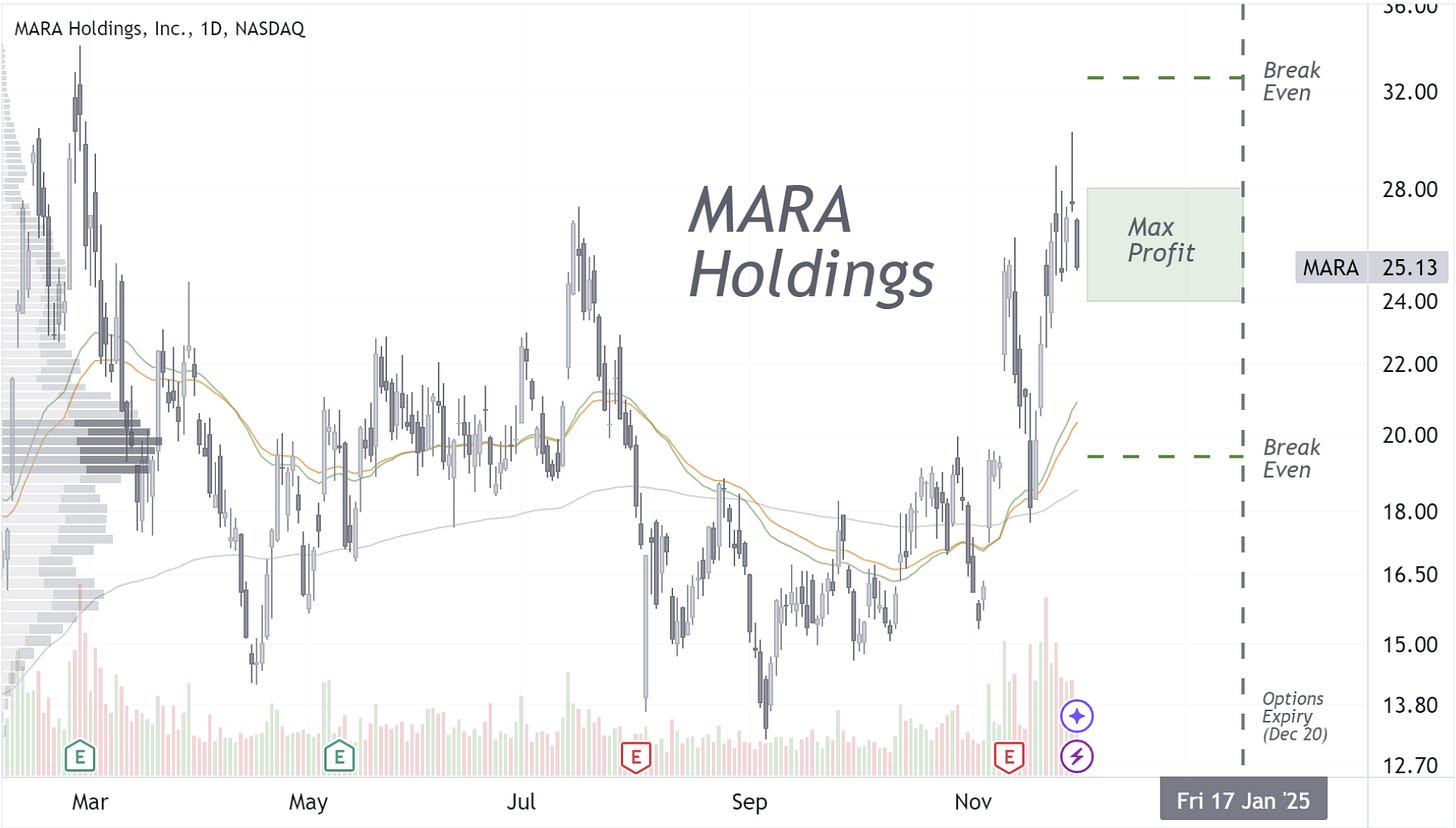

TUESDAY TARGET: Since we were ranting about gold maximalists in the intro, why not play a crypto miner to prove them wrong—at least over the next 4–6 weeks?

Check out the details in the Public Chat.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.