Investors are trying to figure out if, when, or even why Trump is not rescuing the market from his own tariffs. But maybe they’re asking the wrong question. It’s not that Trump has stopped caring about stocks; he’s playing a different game—a longer, subtler game that goes well beyond keeping his rich and clueless golfer buddies happy.

Think about it: tariffs are usually seen as political leverage or blunt negotiating tools—a quick way to rattle foreign governments. But what if the real play here is to deliberately slow U.S. growth, force the Fed into a round of rate cuts, and engineer a weaker dollar? With a cheaper currency, America’s exports become irresistible abroad, and those punitive tariffs bite even harder on foreign imports.

Call it chaos—call it calculated disruption. It’s the end of easy assumptions about American exceptionalism, and a gamble that the long-term payoff will outweigh short-term pain. While Wall Street worries about quarterly earnings, Trump is busy reshaping the global economic landscape. The question isn’t whether markets will bounce back tomorrow—it’s how quickly investors will realize the game has fundamentally changed.

Below, as always, the minimum we need to know to get a feel for what’s cooking:

Europe’s Fiscal Overdrive: A ‘Whatever It Takes’ Sequel

Brace yourself for the biggest pivot in German fiscal policy since reunification. Berlin’s plan to suspend its famed debt brake and tap into endless borrowing—for defense, infrastructure, and much more—signals a historic gamble. Markets cheered at first, until bond vigilantes sniffed out a future tsunami of debt issuance. Negative swap spreads, spiking yields, and a real risk of overshoot are all baked in. If Europe can’t contain borrowing costs, watch its euphoria dissipate faster than a carnival balloon.

This Volatility Spike? Not a One-Off

Wall Street’s top desks warn that we’re only in the “first inning” of a longer, gnarlier volatility cycle. Degrossing by hedge funds, short gamma flows, and shaky liquidity across bond markets all feed a vicious loop. Traders are snapping up VIX calls in droves, and zero-day options are fueling intraday whipsaws. Translation: if your risk management plan relies on calm seas, it’s time for an upgrade.

China’s Two Sessions: Domestic Demand to the Rescue

While the U.S. sets tariffs ablaze, Beijing is quietly pumping stimulus back home. The National People’s Congress just pledged faster government spending, relaxed monetary policies, and a renewed focus on domestic consumption—think infrastructure, AI, and consumer tech expansions. Tariffs may bruise export-driven firms, but a shift to internal demand could soften the blow. Don’t sleep on this as a bullish catalyst for selective China plays.

Get Rich Overnight with Options? Yeah Right...

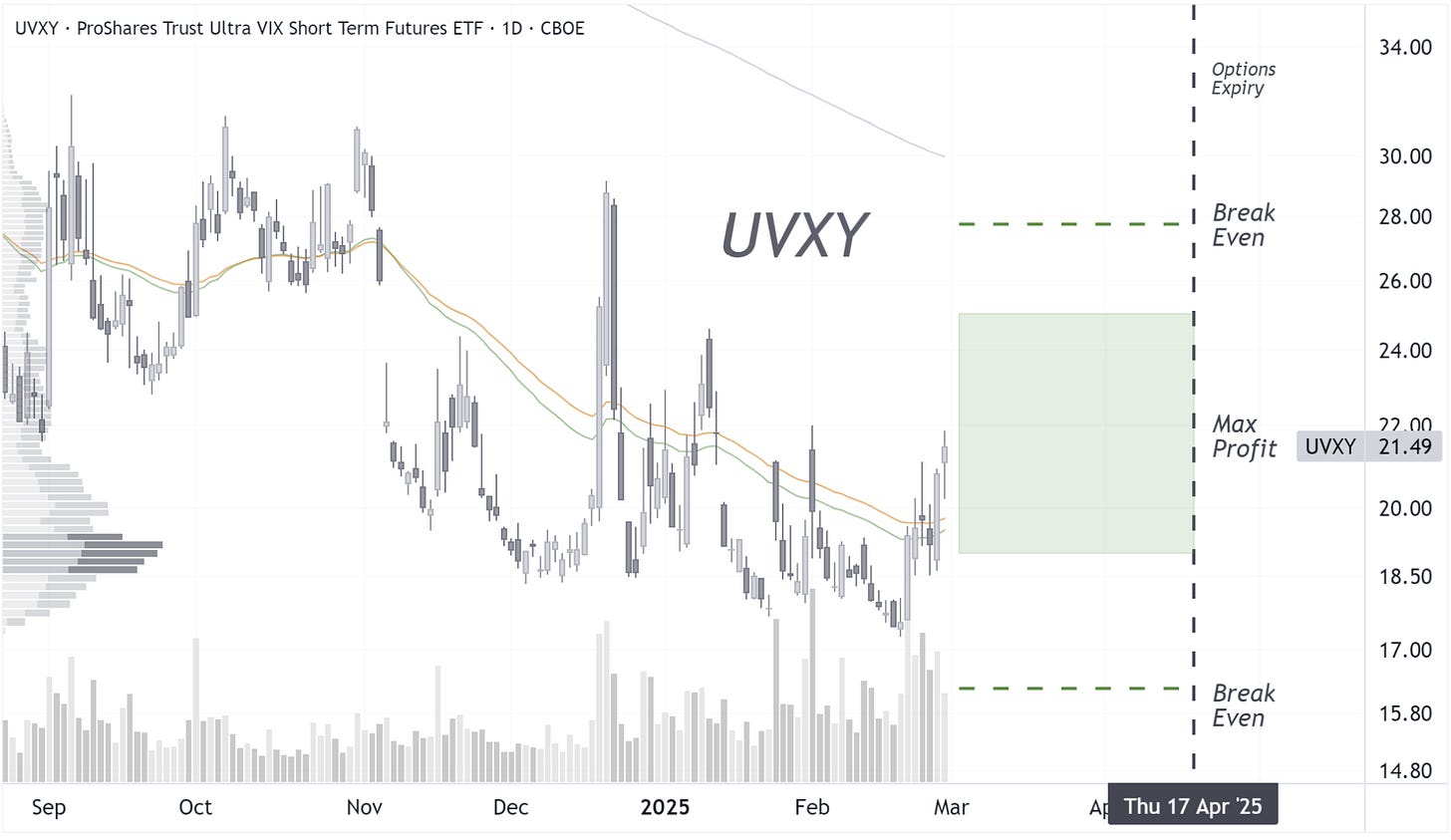

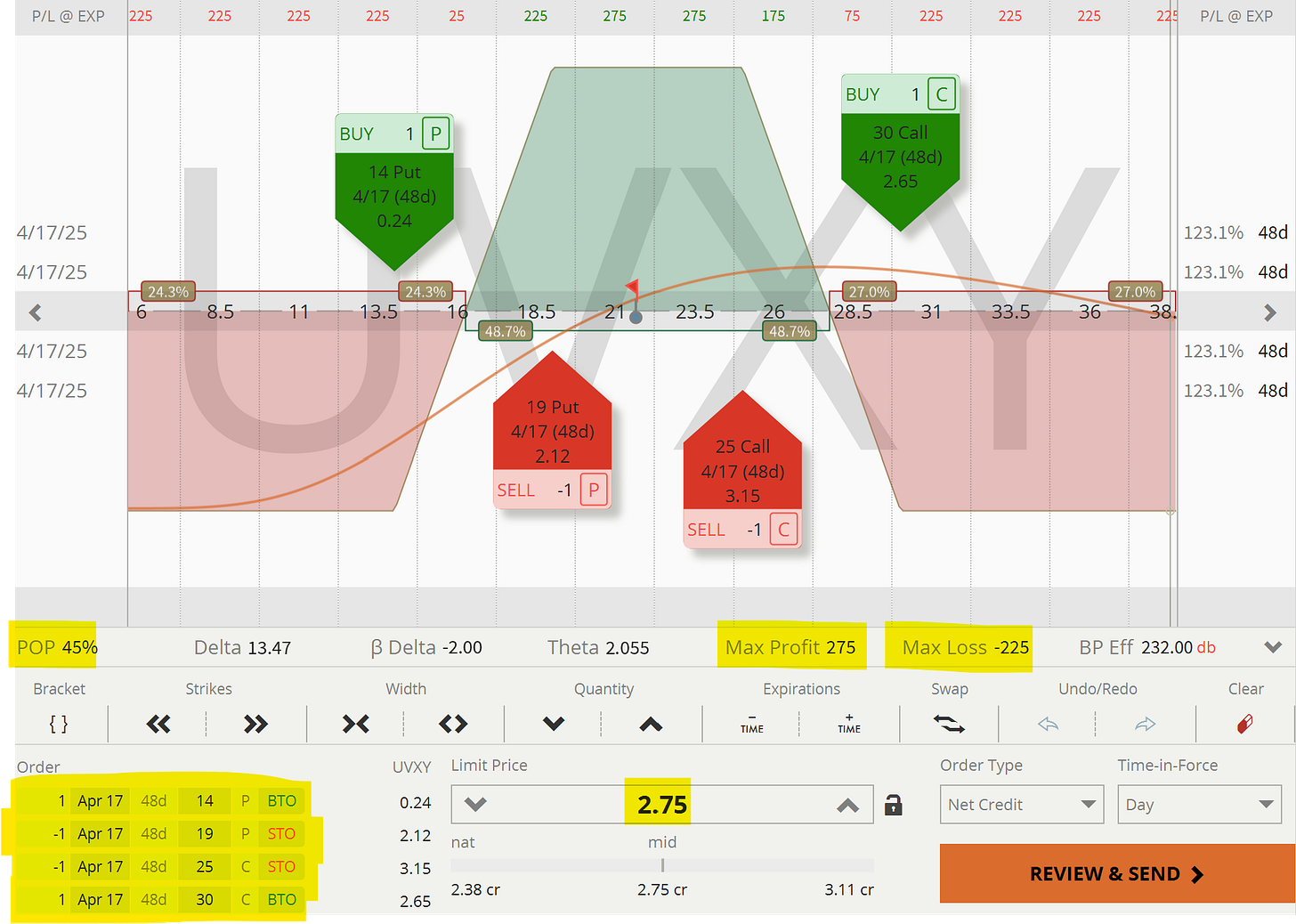

TUESDAY TARGET: When turbulence kicks in, a sideways UVXY play is always fun. It keeps you on your toes but isn't easy to mess up if your nerves are strong. UVXY usually trades with a drag due to the rolling of front- and back-month VIX futures, but when the VIX back month is cheaper than the front month, UVXY actually gets a tailwind instead.

Some trades look great on paper, but execution is what separates real results from empty hype. If you’re wondering exactly how we are approaching this one—when to enter, adjust, or exit—check out the full breakdown in our Trade Alerts section. No jargon, no fluff—just a clear, step-by-step look at the process.

Whether you're new to options or already working with advanced strategies, sometimes a second opinion or fresh idea can make all the difference. If you want to refine your edge, leverage opportunities more effectively, or discuss smart hedging approaches, let’s connect. No sales pitch, no pressure—just a free, 20-minute strategy session to exchange insights and sharpen your game.

Please note, all content is for educational purposes and isn't personalized for individual portfolios or financial advice. Curious about putting any of these ideas into action? Juri von Randow is here to offer guidance or connect you with the right resources.

Share this post